Italy and the euro:‘The People’ on the Label, Bankruptcy Inside

Everybody’s familiar with it: A walk in the rain. Raised hood. The field of vision is restricted, the crackling of the waterproof and windproof textile layers on the ears drowns out the wind as well as the precipitation and the sound of tyres on approaching vehicles.

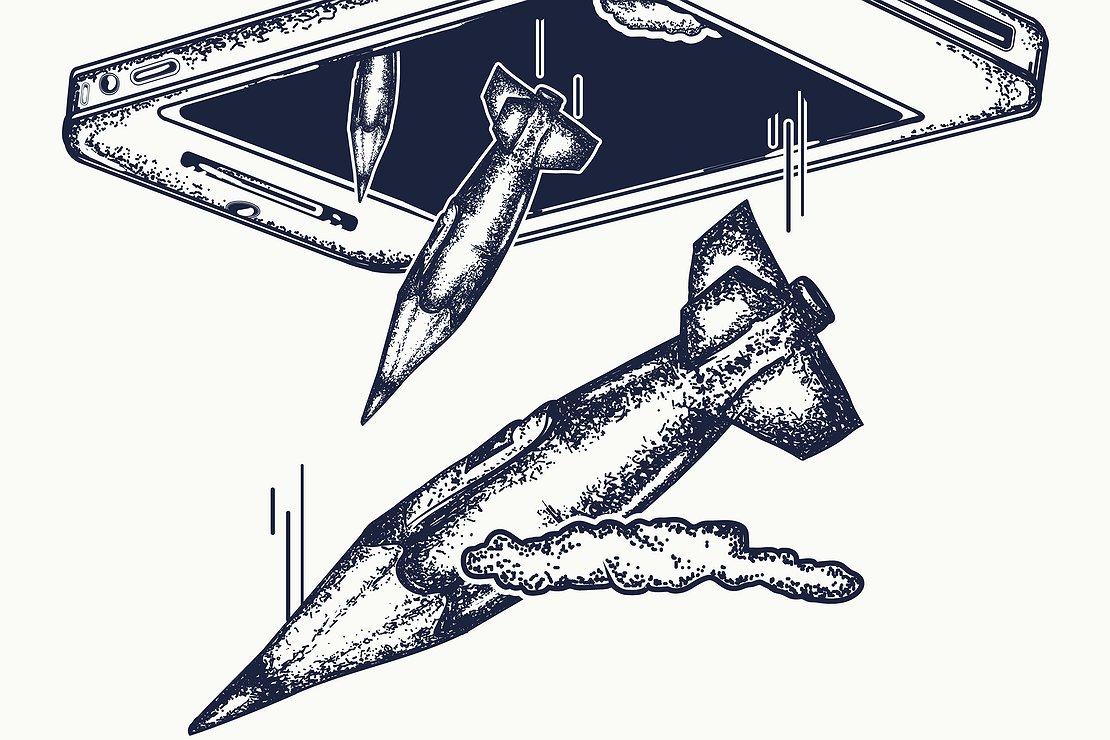

At the moment there’s a lot of scraping and crackling from the hood that is our media. The fuss is considerable: the Russians, it is said, are hacking the whole world; the wolf salute and the monetary policy of the Turks are equally disastrous; surprisingly, heating costs are rising surprisingly; one in five people from Africa seeking protection drowns in the Mediterranean; but according to the world climate report this is in store for all of us anyway; the financial resources for integration aid are to be increased; the DAX is trying to stabilize; various politicians are being forced to move on; the IMF has now officially arrived in the anti-Trump camp, and Greece has overcome the financial crisis for what feels like the ninth time.

The whole mix rains down on us daily as if in a heavy storm, and in all that ‘white truth noise’ (it’s well known that journalism has parted ways from reality) it’s no wonder that almost nobody pays attention to the approaching truck. It would be advisable to do so, however. It is a monstrous thing that is perfectly capable not only of imploding the euro, but of triggering the final crisis of our credit money system: 2.3 trillion euros of debt, not including target 2 liabilities of 471 billion euros, an interest burden on public debt that exceeds the annual (nominal) growth rate, rotten loans in the banking system of 187 billion, an economy that has been shrinking on average by half a percent per year since 2008, and an unemployment rate of over ten percent. Its name: Italy.

You don't have to be an economist to know that Italy has precisely two options: either ‘way to go!’, with even more debt to stimulate demand and get the economy going, or to go the hard way with the goal of renewed competitiveness and attractiveness as a location for investment: reforms, correction crisis, falling wages and prices, even higher unemployment, company bankruptcies. And you don't need to be a fortune teller to know that Salvini, di Maio and their ilk don’t even dream of prescribing this drastic treatment to the people who elected them on the basis of socialist promises of justice.

Due to the fact that Italy has now adopted a ‘people's budget’ which plans for even higher indebtedness, and that it has recently communicated that it is not even thinking about leaving the euro, nobody should now be in any doubt about where the journey is heading. Jean-Claude Juncker calls it the “completion” of economic and monetary union. It is either the total socialization of Italy's debt via the Target 2 system or the liability traps ESM, EDIS, SRB and ESRB, or the direct financing of the Italian state by the ECB, which ultimately amounts to the same thing.

Because even if Italy wanted to go bankrupt – it can't. The EU has long been an “insatiable Leviathan, a conglomerate of powers – the opposite of separation of powers. The Commission sees itself” neither today nor in the future “as the guardian of treaties” between states, but “as a kind of government” of Europe (professor Markus C. Kerber). And governments, both Italian and Brussels, as we know, want to govern for as long as possible. That is their only goal.

What does this mean for us? For you and me? It means that the probability of an open inflation policy and a final failure of the euro is increasing daily. Because the control over the situation, which our politicians grotesquely but logically call ‘the stabilisation of the financial system,’ has long been in amok mode. Jürgen Stark, former chief economist of the ECB, states it clearly: “The steering of the entire money supply has got completely out of control. Not only is it simply printed, but nobody knows anymore who is generating how much virtual money and where, and where it is actually going. Even how much credit money the banks are generating from the already absurd masses of central bank money is beyond any control.”

We can only protect ourselves by getting ourselves some ‘barbarous relics’ (Keynes) such as gold. No matter how small the amount one can afford – it is the most effective weapon against the ‘fully comprehensive insurance’ for lazy and irresponsible people, against the ‘zero-interest command economy’ of the ECB and against the theft of one's own belongings, one's own effort and one's life's work by the state. Because that is exactly what will happen – because, as history teaches us, in the end it is always what happens.

Translated from eigentümlich frei, where the original article was published on 10th October 2018.